The market is trending down after falling through important support levels. We are likely to see more volatility (up and down movement) in the market as investors debate whether the economy will return to a recession.

For now add down side protection to your portfolio as the trend remains down.

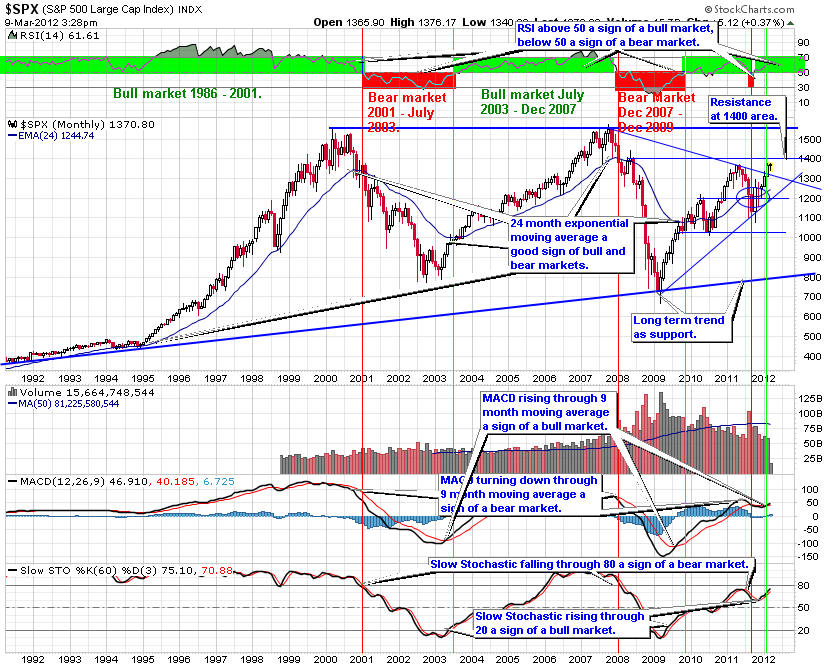

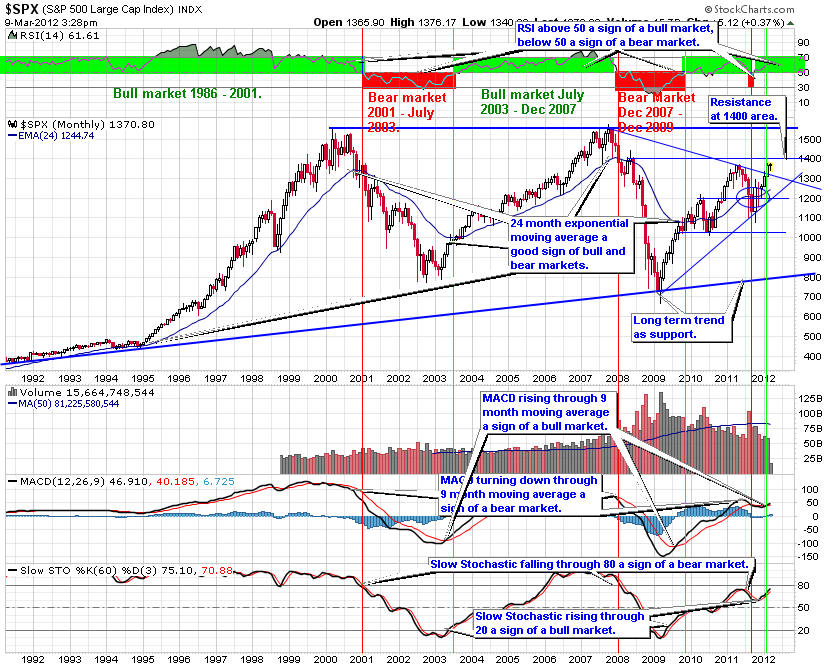

This is a monthly chart for the S&P 500 showing 20 years of performance. Since this index is the one used by professional traders, it is important to understand how it is performing. This chart is also excellent at defining the longer term trends for the market.

The end of the bear market and the stock market bottom came at the long term rising trend. Shortly after the monthly Slow Stochastic rose through 20 then the MACD rose through its 9-month moving average. Finally, the RSI climbed through the 50 level, though it is testing this bull-bear market indicator now.

From a monthly chart perspective, the recent rally in the market ended and the market is trending lower as all signals point down. This is a serious sign that we maybe in for a longer period of market weakness.

The S&P 500 turned down through the 24 month exponential moving average. A bear market begins when the index fell through the 24-month exponential moving average.

Also, the RSI dropped below the 50 level, another important indicator of bear markets (if the RSI remains below 50 then we are in a bear market) and turned back down.

The MACD crossing down through zero is another sign of the transition from bull market to bear market. As shown on the chart the MACD was at a high point when it turned down through its 9-moonth moving average.

Finally, the Slow Stochastic turned down before reaching 80, another sign of the beginning of the bear market.

There is support at the 1,020 area.

The RSI is falling through the 50 area, a sell sign.

The MACD is at a high point where it is falling through the 9-month moving average, a sell signal.

The Slow Stochastic is turning down before reaching 80, a sign of weakness in the market.

From a monthly chart perspective the rally is ending. I expect the trading range for 2011 to be 1,400 as the high and 1,000 as the low.

You can click on this Big Picture S&P 500 link below to see a current version of this chart.

The four-year weekly S&P 500 trend chart shows the break down of the market that began in March 2011. The declining volume was another indication the market was getting weaker.

The test of support at the rising trend and the 50-week moving average failed as the market retreated to the 1,200 area.

RSI is below 50, a sign of a down trend.

The MACD has reached a high point where it turned down through the 9-week moving average, giving a sell sign.

The Slow Stochastic turned down before reaching 80, a sign of weakness. Now this indicator is bouncing along the 20 area without falling through.

The weekly chart pattern indicates the S&P 500 is turning down. The descending trend offers resistance.

You can click on this S&P 500 Weekly Chart link below to see a current version of this chart.

The S&P demonstrates a useful learning pattern. The attempt to push up through the resistance at the 1,350 area in the middle of May failed, a sign of a new move down. This move up formed a lower high another indication the market was about to fall further.

Initially, the 200-day moving average held as support telling us the market would rally. When the third attempt to rise through resistance at the 1,350 area failed, we received another indication the market would fall. The close below the 200-day moving average is another sign the market is trending down.

These are excellent chart patterns that help identify the market trend.

Now to the present.

The S&P 500 rebounded up from support at the recent low in the 1,125 area. There is resistance at the steep descending trend and the 50-day moving average. Monitor volume on any attempt to break out through resistance.

RSI is below 50 a sign of a down trend.

The MACD is rising through its 9-day moving average, a buy sign.

The Slow Stochastic turned up through 20, giving a buy sign.

The slope of the 150-day moving average is another important indicator. When it slopes positive it is telling us the trend is up. When it is negative, the trend is down.

For now the slope of the 150-day moving average is negative, a sign of a down trend.

For 2011, I am expecting the market to trade in a range 1,400 area as the high 1,000 as the low.

This link S&P 500 Daily Chart will give you a current perspective on the S&P 500.

Given this analysis of the S&P 500 trend line charts, it is important to position your portfolio for a market that is more likely to trend in a range with cyclical rallies and pull backs.

Selecting the right sectors and stock picking will become more important to your success. Look to buy on dips in the market to important support levels. Then add down side protection at interim high points using trailing stops and protective put options to help improve the overall return.

The charts of the S&P 500 trend lines provide a good way for investors to align their portfolios with the overall market trends. Picking the right sectors and stocks will become even more important. Look to buy on dips in the price of the S&P 500 trend charts on the next pull back.

Be sure to use proper capital management techniques including trailing stops, protective put, covered call options and position sizing. When the pull back ends, look to add to long positions with stocks and ETFs from the sectors that are likely to outperform the overall market. Keep in mind, Warren Buffett's first rule of investing is to not lose money. Be patient waiting for good entry points.

As of the end of Spetember 2011, our Stock Portfolio was up 12.3 percent and our sector portfolio was up 5.4 percent. The market as measured by the S&P 500 was essentially flat.

Request a membership with a free one month trial subscription with no risk or obligation.

If you decide to continue at the end of the month long trial, your subscription starts automatically. If you decide to cancel before the end of the trial, you will not be charged a thing. No risk, no obligation.

You have nothing to lose and a lot to gain as we have beat the market every year since our inception.

If you are interested in a free monthly newsletter on the stock market trends, please send an email to [email protected] with your email address stating you wish to receive the Free Monthly Newsletter and you will be added to the list.