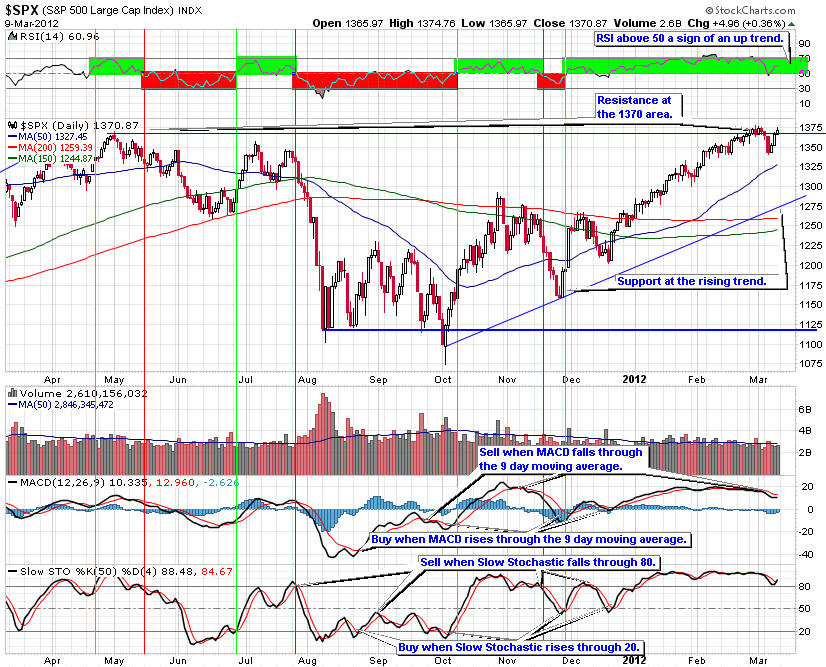

The recent pause might be the beginning of a correction. Let's see if support holds or fails before making any commitment.

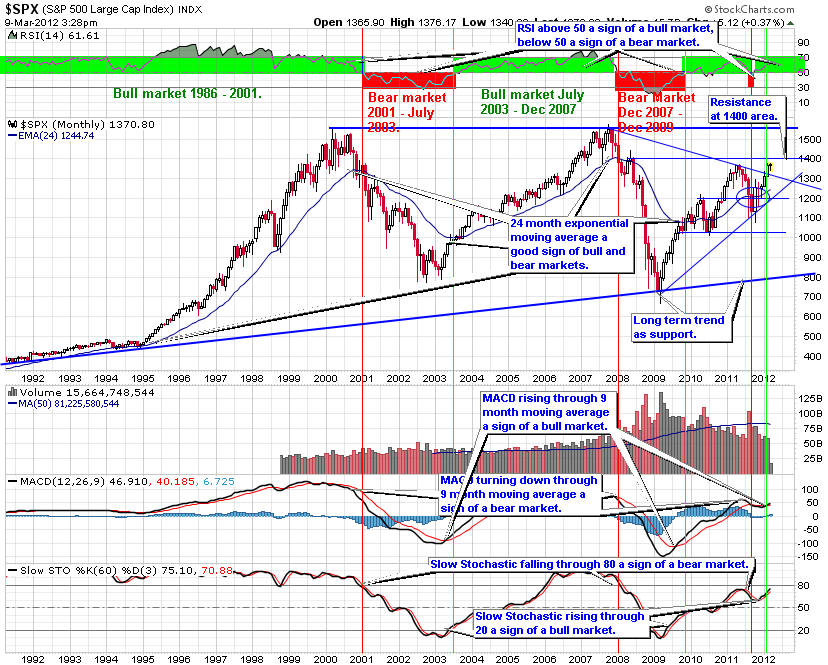

Starting with the indexes gives an overall perspective to the markets. This is monthly chart for the S&P 500 showing 20 years of performance. Since this index is the one used by professional traders it is important to understand how it is performing. This chart is also excellent at defining the longer term trends for the market.

The bull market of the last five years broke down when the S&P 500 turned down through the 24 month exponential moving average. The bear market began when the index fell through the 24-month exponential moving average. Also, the RSI tested the 50 level, another important indicator of bear markets (if the RSI remains below 50 then we are in a bear market) and turned back down. The MACD crossing down through zero is another sign of the transition from bear market to bull market. Finally, the Slow Stochastic fell through 80 as another sign of the beginning of the bear market.

The 24-month EMA has held as support indicating the market will continue to trend upward. Moreover, the S&P 500 closed above the recent high, a sign the rally will continue.

The RSI is above 50 level a sign of a bull market. The MACD rose through the zero level another sign of strength. The Slow Stochastic turned back up at the 50 level, indicating another the rally is continuing.

From a monthly chart perspective the rally is continuing as it breaks through the 1,300 level. I expect the trading range for 2011 to be 1,400 as the high and 1,000 as the low.

You can click on the link below to see a current version of this chart.

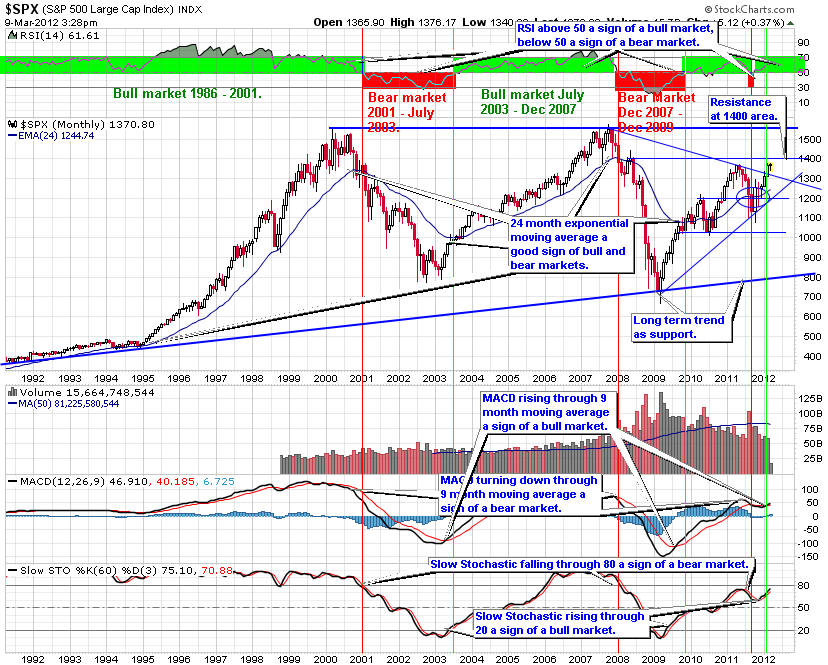

The four-year weekly S&P 500 trend chart shows the formation of an ascending triangle, a bullish formation. The price is trying to break out through resistance at the 1,300 area. However, volume has been below average a sign not all investors are on board. Monitor any retest of this breakout to see if it holds. If it fails to hold, look for a move down to the rising trend. Should the breakout at the 1,300 area hold, look for the rally to continue to the 1,425 level at least.

RSI is above 50 a sign of an up trend. The MACD is trending up a positive sign for the market, though it is near a high point. The Slow Stochastic is above 80 where it will turn down giving a sell sign eventually.

The ascending triangle suggests that the market may turn down as it tests the 1,300 level. If it does, look to buy shares at the support of the rising trend, if it holds. On the other hand, if volume picks up it might be enough to push through this resistance level and keep the rally intact.

Should the S&P 500 break out through the resistance of the 1,300 area with above average volume, it is a good sign the rally will continue. Look to buy quality stocks that have strong earnings and revenue growth.

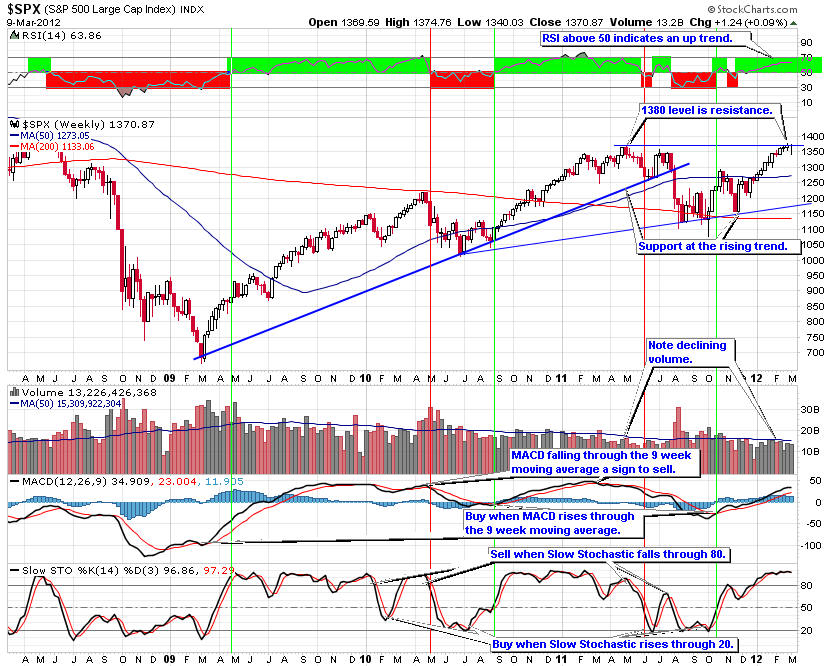

The S&P 500 is testing support at the lower rising trend. If it closes below the lower rising trend and the 50-day moving average, it is an indication the market is correcting.

RSI is above 50 a sign of an up trend. The MACD fell through its 9-day moving average, a sell sign. The Slow Stochastic fell through 80 giving another sell sign.

The slope of the 150-day moving average is another important indicator. When it slopes up it is telling us the trend is up. When it points down the trend is down.

The slope of the 150-day moving average remains positive, a sign of an up trend.

The S&P 500 remains in an up trend for now.

You can link to a current version of this chart below.

Currently, we are in a rising trend that has lasted for more than 7 months. Until there is a definite change, the trend remains up.

Given this analysis of the S&P 500 trend line charts, it is important to position your portfolio for a market that is more likely to trend in a range with cyclical rallies and pull backs.

Selecting the right sectors and stock picking will become more important to your success. Look to buy on dips in the market to important support levels. Then add down side protection at interim high points using trailing stops and protective put options to help improve the overall return.

The charts of the S&P 500 trend lines provide a good way for investors to align their portfolios with the overall market trends. Picking the right sectors and stocks will become even more important. Look to buy on dips in the price of the S&P 500 trend charts on the next pull back.

Be sure to use proper capital management techniques including trailing stops, protective put, covered call options and position sizing. When the pull back ends, look to add to long positions with stocks and ETFs from the sectors that are likely to outperform the overall market. Keep in mind, Warren Buffett's first rule of investing is to not lose money. Be patient waiting for good entry points.

As of the end of January 2011, our Stock Portfolio was up 5.8 percent and our sector portfolio was up 4.2 percent for 2011. The market as measured by the S&P 500 was up 2.8 percent for 2011.

Request a Premier membership with a free four week trial subscription with no risk or obligation.

If you decide to continue at the end of the four-week trial your subscription starts automatically. If you decide to cancel before the end of the trial, you will not be charged a thing. No risk, no obligation.

You have nothing to lose and a lot to gain, as we have beaten the market every year since our inception.

If you are interested in a free monthly newsletter on the stock market trends, please send an email to [email protected] with your email address stating you wish to receive the Free Monthly Newsletter and you will be added to the list.