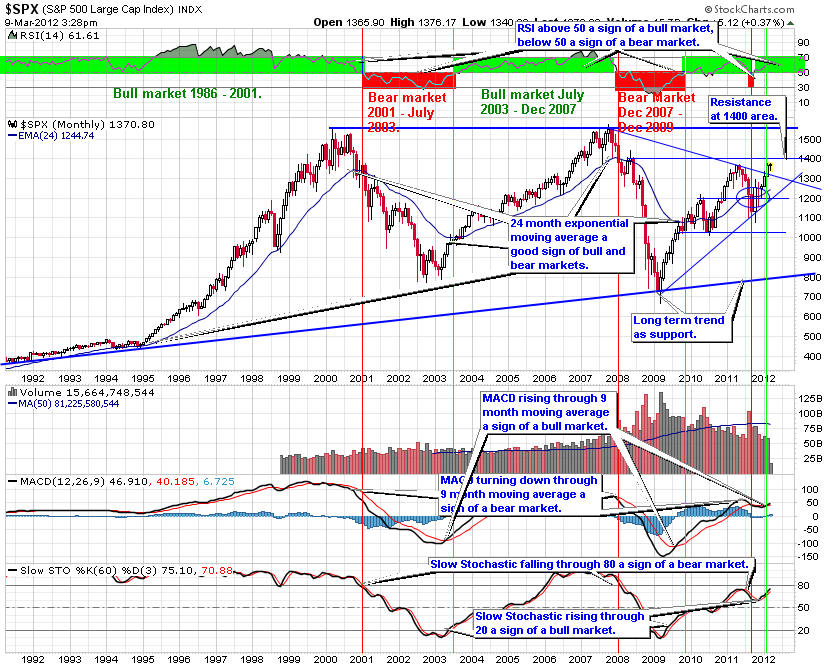

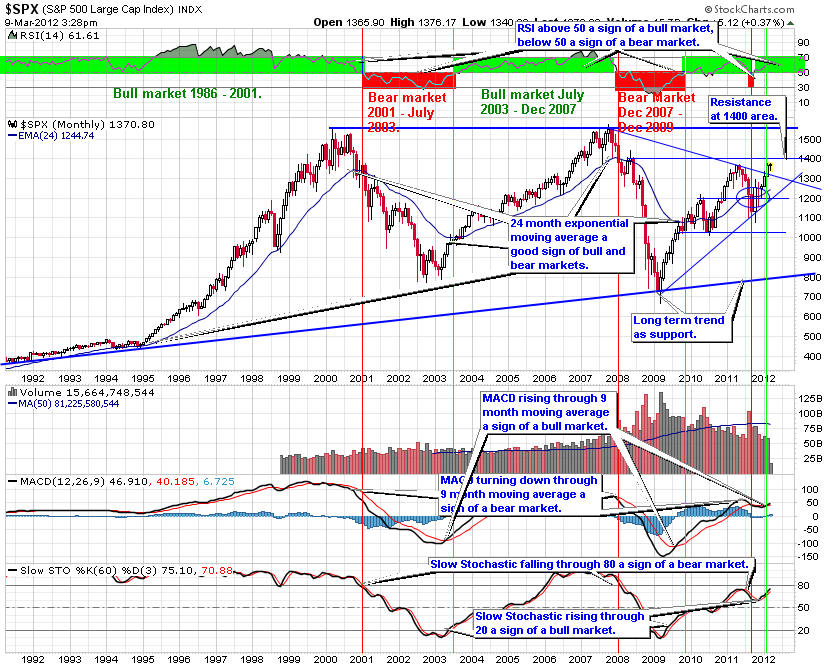

This is a monthly chart for the S&P 500 showing 20 years of performance. Since this index is the one used by professional traders, it is important to understand how it is performing. This chart is also excellent at defining the longer term trends for the market.

The end of the bear market and the stock market bottom came at the long term rising trend. Shortly after the monthly Slow Stochastic rose through 20 then the MACD rose through its 9-month moving average. Finally, the RSI climbed through the 50 level, though it is testing this bull-bear market indicator now. Most recently, the S&P 500 crossed through the 24-month exponential moving average. As long as it remains above this level, a bull market is in place.

In June 2010, the market fell through the 24-month exponential moving average. This week the index closed below the 24-month EMA, indicating the rally is over and a new move down is possible.

The RSI is below 50 a sign of a down trend. The MACD is trending up. Monitor how it handles the zero level to get an idea of the strength of this move. If the MACD turns down through its 9-month moving average it will be a sell sign. The Slow Stochastic is pausing at the 50 level, a potential resistance area. If it turns down it will be another sign of a new bear market.

From a monthly chart perspective the rally is faltering. Any further move down from here will indicate a new bear market is beginning.

For now, I intend to invest as though we are in a market that trends sideways in a wide channel with 900 as the low and 1,250 as the high. The rally of the last 12 months came as a rebound from an oversold condition as investors feared the worse. Going forward, the weakness in the U.S. economy will contain any rally.

You can click on the link below to see a current version of this chart.

The four-year weekly S&P 500 trend chart shows that the drop in the market that began in early May 2010. Support at the 50-week moving average failed as well. There is support at the 930 area.

RSI is below 50, a sign of a down trend. The MACD has reached a high point where it turned down through the 9-week moving average, giving a sell sign. The Slow Stochastic is now below 20 where it can remain for some time. Any move up by the Slow Stochastic through 20 is a buy sign.

The weekly chart pattern indicates the S&P 500 turned down. we could see a rebound up to the descending trend. If this takes place it represents a good place to buy the short ETFs and add down side protection to any long positions you wish to hold.

You can click on the link below to see a current version of this chart.

The S&P demonstrates a useful learning pattern. First, the attempt to push up through the 50-day moving average in the middle of May failed, a sign of a new move down. Next this move up formed a lower high another indication the market was about to fall further. Both are excellent chart patterns telling us the market would turn down. The 50-day moving average will offer resistance on the next attempt to rally.

Now to the present. The S&P 500 fell back from the 200-day moving average, a sign of weakness. he descending trend and the 50-day moving average offer additional resistance. The 1,050 provides some support as well as the neckline of the head and shoulders formation.

RSI is below 50 a sign of a down trend. The MACD could be turning down though its 9-day moving average. If it does it is a sell sign. The Slow Stochastic turned down before reaching 50, a sign of weakness.

The slope of the 150-day moving average is another important indicator. When it slopes up it is telling us the trend is up. when it points down the trend is down. Until the last few days the slope of the 150-day moving average was up. Now it is flat. If the market can move above the 150-day moving average, we can be assured the slope will remain positive. We will watch this carefully.

A head and shoulders pattern has formed, a bearish formation. If the index falls through the 1,025 level look for a drop to the 900 level based on the measure rule.

The test of the 1,025 will be important.

For 2010, I am expecting the market to trade in a range 1,250 area as the high 900 as the low.

Given this analysis of the S&P 500 trend line charts, it is important to position your portfolio for a market that is more likely to trend in a range with cyclical rallies and pull backs.

Selecting the right sectors and stock picking will become more important to your success. Look to buy on dips in the market to important support levels. Then add down side protection at interim high points using trailing stops and protective put options to help improve the overall return.

The charts of the S&P 500 trend lines provide a good way for investors to align their portfolios with the overall market trends. Picking the right sectors and stocks will become even more important. Look to buy on dips in the price of the S&P 500 trend charts on the next pull back.

Be sure to use proper capital management techniques including trailing stops, protective put, covered call options and position sizing. When the pull back ends, look to add to long positions with stocks and ETFs from the sectors that are likely to outperform the overall market. Keep in mind, Warren Buffett's first rule of investing is to not lose money. Be patient waiting for good entry points.

As of the end of June2010, our Stock Portfolio was up 7.9 percent and our sector portfolio was up 8.2 percent. The market as measured by the S&P 500 was down 8.3 percent.

Request a membership with a free four week trial subscription with no risk or obligation.

If you decide to continue at the end of the four-week trial your subscription starts automatically. If you decide to cancel before the end of the trial, you will not be charged a thing. No risk, no obligation.

You have nothing to lose and a lot to gain as we have beat the market every year since our inception.

If you are interested in a free monthly newsletter on the stock market trends, please send an email to [email protected] with your email address stating you wish to receive the Free Monthly Newsletter and you will be added to the list.