When analyzing monthly stock market trends, I use the S&P 500 charts to identify important trend lines. Trend following is a proven strategy to beat the market and grow your stock portfolio. Technical analysis provides the tools to analyze and identify trends in the stock market. Since the S&P 500 chart is the one used by professional traders for their analysis, it is important to understand how it is performing.

The analysis of the S&P 500 trend line starts with the 20-year monthly view of the S&P 500 chart. Next, we examine the weekly chart of the S&P 500 trends to get a shorter-term view. Finally, we analyze the one-year daily chart of the S&P 500 trends to get an even shorter-term view. On each version of the charts of the S&P 500 trend line, the view and the value of the indicators change, as we move from a monthly to a weekly and then a daily chart.

Starting with the monthly view of the S&P 500 trend chart, the bull market of the last five years turned down, as the index fell below the 24-month exponential moving average. The Relative Strength Indicator (RSI) is below 50, indicating a downtrend is in place. The Moving Average Convergence Divergence (MACD) fell below zero, a sign stock market trend has reversed and we have entered a bear market. Finally, the Slow Stochastic fell through zero, another sign of a bear market.

The analysis of the monthly trends of the S&P 500 chart shows we remain in a bear market with key resistance at the 24-month exponential moving average. In addition, support at the 25 year rising S&P 500 trend line has been tested and held, so far. However, the Slow Stochastic rose through the 20 level. If it is able to stay above 20, it is an early buy sign. The other indicators have not yet flashed an end of the bear market. From the monthly view, we remain in a bear market.

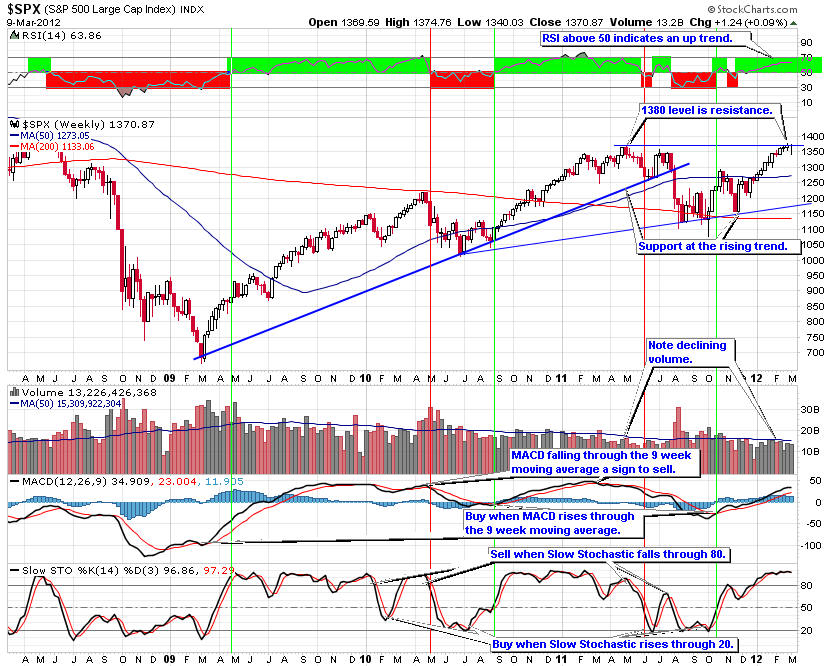

The three-year weekly S&P 500 trend line chart shows more closely the transition from a bull to a bear stock market. So far, the descending trend line and the 50-week moving average are the primary resistance levels for this view of the bear market.

Earlier this year the S&P 500 fell through support at the 800 level down to the 650 area. The S&P 500 trend then reversed course, generating a nice rally. There is resistance at the 930 area that is being tested. Just above, the 970 area offers additional resistance.

As mentioned in the June 2009 newsletter, the 50-week moving average will offer resistance. The S&P ran up to the combined resistance of the 940, 970 and the 50-day moving average. All three have held. In addition, the falling volume is a concern. If volume remains below the weekly average, it is a good sign that the up trend cannot continue.

RSI is at 50. If it falls further, it will be a sign of a down trend. The MACD turned up through the nine-week moving average, a buy sign. It is turning over as it reaches the zero level, a sign of weakness. Earlier the MACD showed positive divergence indicating the uptrend would begin in early March. Slow Stochastic is turning down, giving a sell sign.

Long term, the trend of the S&P 500 chart is still down. The weekly pattern indicates the S&P 500 trend is reaching an important decision point. There are signs it will be unable to rally further and from a weekly perspective we could either trend sideways or turn down.

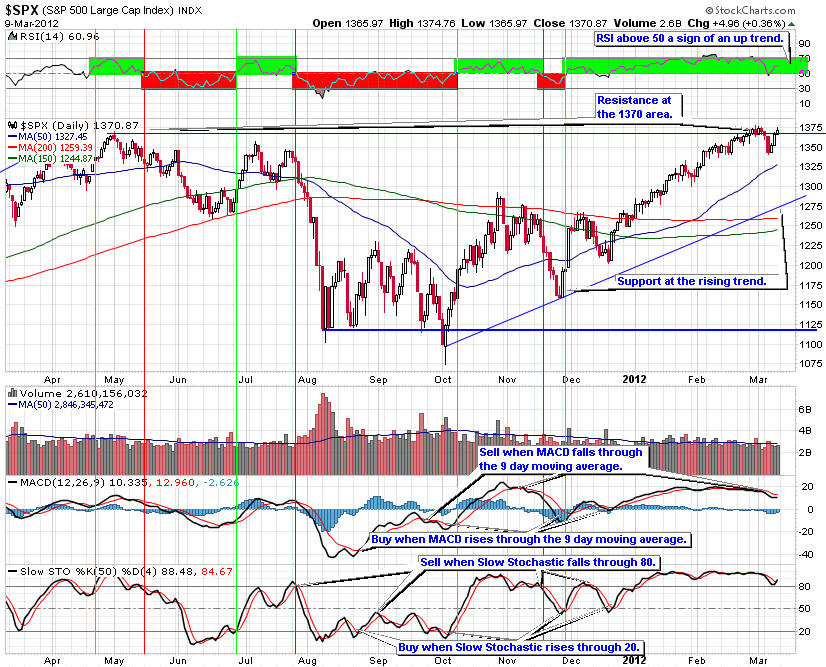

The daily S&P 500 shows the topping price action that began in May. Resistance at the 950 level and the descending trend is holding. There is support at the 875 level and the 50-day moving average. these levels define the horizontal channel that is in place now.

Volume has been trailing off, which is not a good sign for the market to keep going up. A break below 875 is an indication that the market will retrace some of its gains possibly to the 800 level.

RSI is below 50 indicating a down trend. The MACD turned down through the 9-day moving average, a sell signal. The Slow Stochastic fell through 80, giving another sell sign.

The daily chart of the S&P 500 is showing the market is turning down. Since we are entering the second quarter earnings season and the slower summer period, we are likely to drift down unless there is an unforeseen news event. Monitor support of the 50-day moving average and the 875 level.

Given this analysis of the S&P 500 trend line charts, it is important to have your portfolio positioned for a pull back in the market. It is prudent to add down side protection and/or reduce your long positions.

The charts of the S&P 500 trend line provide a good way for investors to align their portfolios with the overall market trends.

Bear market rallies offer investors a good time to buy stocks and ETFs in leading sectors. Look to buy on dips in the price of the S&P 500 trend charts on the next pull back. Be sure to use proper capital management techniques including trailing stops, protective put, covered call options and position sizing. when the pull back ends, look to add to long positions with stocks and ETFs from the sectors that are likely to outperform the overall market. Keep in mind, Warren Buffett's first rule of investing is to not loose money. Patience is key when markets are moving down.

Our Premium Members receive weekly analysis of market trends of all major indexes and industry sectors. They also receive frequent updates when conditions warrant, so they are prepared to trade and invest with the trend. Moreover, our stock and sector portfolios have beat the market every year since our inception in 2005. For 2009, our stock portfolio is up 9.9% for the year.

Try the free four week subscription to our Premium Members pages and receive:

If you decide to continue at the end of the four-week trial your subscription starts automatically. If you decide to cancel before the end of the trial, you will not be charged a thing. No risk, no obligation.

Give the Premium Membership a try. You have nothing to lose and a lot to gain and we have beat the market every year since our inception.