To make money in the stock market it is important to follow the trend. I believe it is best to begin with the big picture in mind and then work our way down to weekly and then daily views of the charts. You will notice that the chart and the value of the indicators change as we move from a monthly to a weekly and then a daily chart. This is a normal part of the technical analysis.

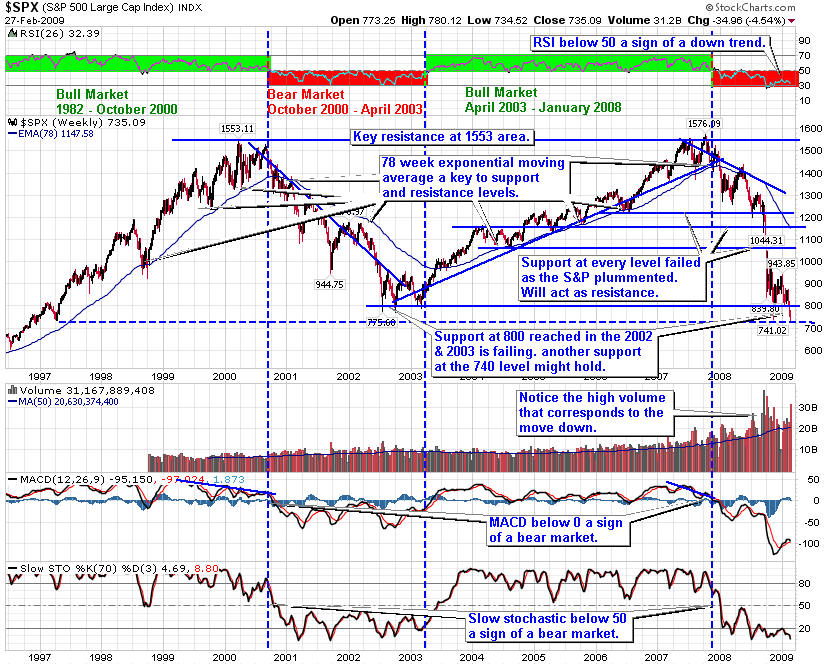

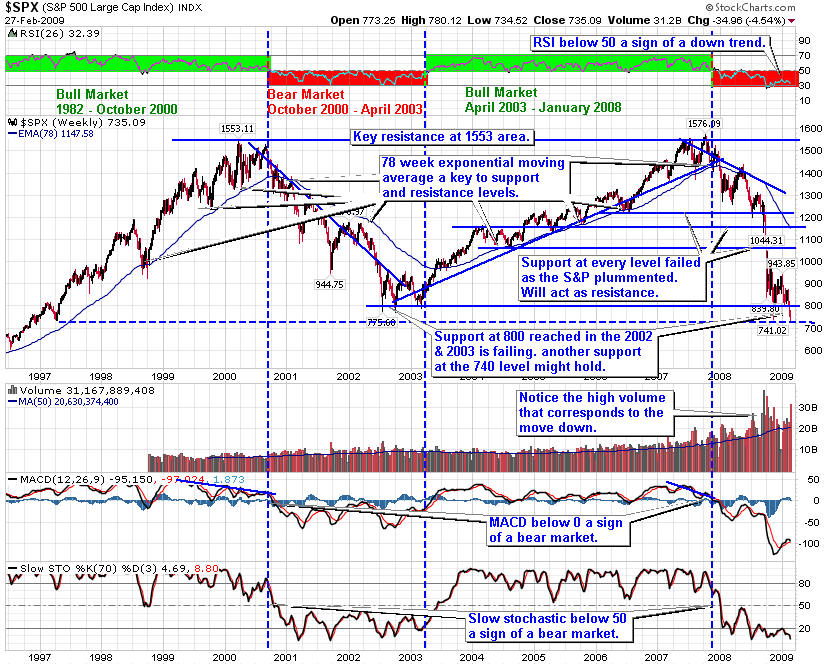

Let's start with the long term view of the S&P 500. The Relative Strength Index (RSI) seems to be a good indicator of the cyclical bull and bear markets. In addition, the 78 week Exponential Moving Average (EMA) acts as support in a bull market and resistance in a bear market.

In January we fell into a bear market as the RSI dropped below 50. The index fell through the rising trend line and the 78 week exponential moving average and MACD crossed below zero. This is consistent with the fundamentals of a weakening economy, and a recession. It is best to remain nimble during times like this.

The first support level looks to be just above the 1200 level. We are testing the 78 exponential moving average, which is a normal occurrence. If this resistance level holds, then it is a sign the market will fall further and you could go short.

The weekly S&P 500 below was in a bullish ascending triangle that broke to the down side. It is now being retested. If the current move up can hold then look for resistance at the 50 week moving average.

Support is now at the 200 day moving average. RSI above 50 indicates an up trend. MACD rose up through the 9 week moving average, a buy sign. Slow Stochastic also indicates an up trend.

As predicted we are seeing rebound to the 50 week moving average, a key resistance level. I expect this resistance level to hold and the market should pull back from here.

The daily S&P 500 chart below resistance at the 200 day moving average and the 1,400 level. I expect these levels to hold and the market to move down from here.

RSI is above 50 indicating an up trend. The MACD gave a sell signal indicating a move down. The Slow Stochastic signaled a move down when it fell through 80. This indicator is often early and a bit whippy, so it may move back up again.

In bear markets it is best to be nimble and/or use risk protection such as trailing stops, protective put options and even covered call options.

Given this perspective, it is important to be patient looking for good opportunities to enter longs that are able to overcome the downward bias in the market. for example during the last month technology stocks have done well, helping out Premium Capable Companies Portfolio to continue to out perform the market.

I expect the market to pull back from this resistance level and trend down. It will be important to add down side protection to your long positions either through stops, protective put options and/or covered calls. On any rise to a key resistance level look to go short either through selected stocks or the ultra shorts ETFs SDS, and QID.

Try the free four week subscription to our Premium Members pages and receive:

At the end of the four week trial if you decide to continue you may continue with either a quarterly or annual subscription. If you decide to cancel before the end of the trial, no problem. You will not be charged a thing.

Give the Premium Membership a try. You have nothing to lose and a lot to gain and we have beat the market every year since our inception.