Generally, I believe it is best to begin with the big picture in mind and then work our way down to weekly and then daily views of the charts. You will notice that the chart and the value of the indicators change as we move from a monthly to a weekly and then a daily chart. This is a normal part of the technical analysis.

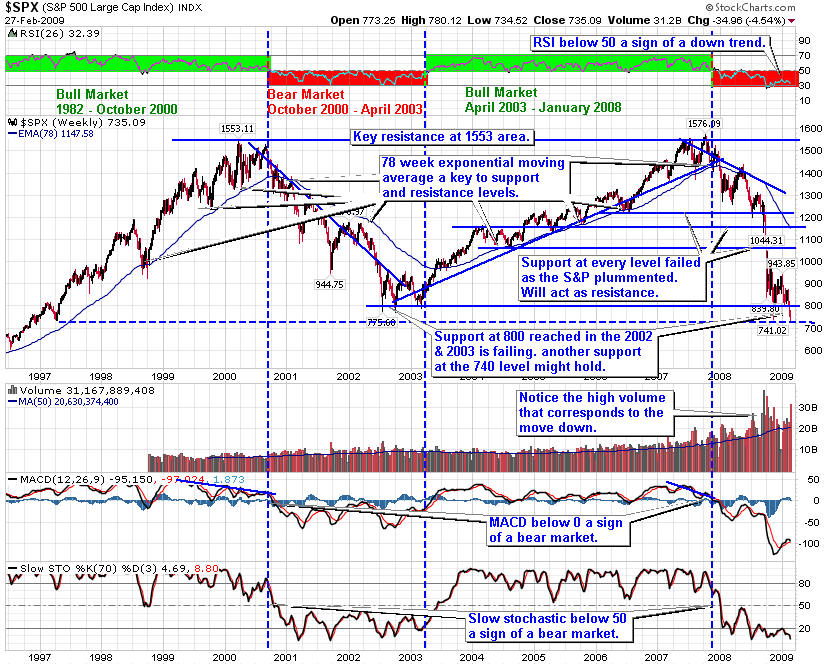

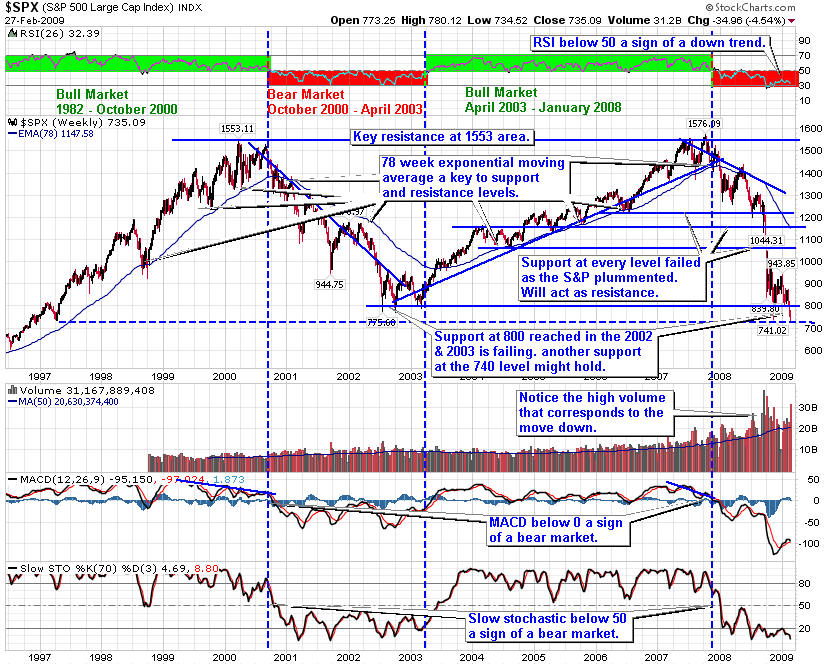

Let's start with the long term view of the S&P 500. The Relative Strength Index (RSI) seems to be a good indicator of the cyclical bull and bear markets. In addition, the 78 week Exponential Moving Average (EMA) acts as support in a bull market and resistance in a bear market.

In January we fell into a bear market as the RSI dropped below 50, the index fell through the rising trend line and the 78 week exponential moving average and MACD crossed below zero.. This is consistent with the fundamentals of a weakening economy, and likely a recession. It is best to remain nimble during times like this.

The first support level looks to be just above the 1200 level. However, we can expect to retest the 78 week exponential moving average at some time in the future.

The weekly S&P 500 below was in a bullish ascending triangle that broke to the down side. Support is now at the 200 day moving average. RSI below 50 indicates a down trend.

MACD broke down through the 9 week moving average, a sell sign. Also we see negative divergence on the MACD where the indicator shows a down trend and the price has not yet fallen. This was another sign that we are likely to see more weaknesses in the market in the near future. As a result we should expect more market volatility over the next couple of months.

The daily S&P 500 chart below shows lower highs as the index is unable to move higher, which is a sign of a market top, indicating we are in a bear market.

RSI is below 50 indicating down trend. The MACD gave a buy signal but is now turning down. For now it is best to be ready to go long if support holds or go short if it fails. In the mean time patience is the best way to go, unless you are a day trader.

Given this perspective, it is important to be patient looking for good opportunities to enter longs that are able to overcome the downward bias in the market. It will be important to add down side protection to your long positions either through stops, protective put options and/or covered calls. On any rises to sresistance level look to go short either through selected stocks or the ultra shorts ETFs SDS, and QID.

Our Premium Members get to have access to many more charts on the market as well as economic analysis with the Weekly Market Update they receive every Sunday night. They also receive email messages of buy and sell ideas just before they happen as well as access to detailed stock analysis of all stocks on the Watch List. I also provide intraweek updates on important market action. If you are interested, sign up for the four week free trial.