The price of oil has climbed despite the lack of demand and

a glut of surplus crude. Moreover, crude remains in contango. Benchmark crude closed near its highest level in eight

months on

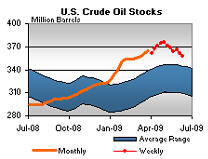

Inventories Way above Average

Inventories of crude have risen above their five-year average range despite lower demand

from the recession. As shown in the chart from the

Inventories of crude have risen above their five-year average range despite lower demand

from the recession. As shown in the chart from the

Impact on the Economy

Each $1 increase in the price of gasoline costs the

Each $1 increase in the price of gasoline costs the

According to James Hamilton, an economist at the

While gasoline prices are not as high as they were in 2008, they are on the

rise as shown in the chart on the right from the

Any business that depends on energy is feeling the affects of higher prices for crude. The transportation sector, especially airlines and trucking companies are hit the hardest. We have heard how the airlines are charging for everything from checked bags to WiFi access to try to offset the higher cost of fuel. The cost of goods that are shipped by air or truck are also directly affected. This will flow to consumers as higher prices at the store.

Higher energy prices will hold any economic recovery in check. Over time, consumers will adapt to higher prices adjusting their spending habits. In addition, the high cost of energy will help spur innovation. However, any affects from new buying habits and innovation will be years in coming. In the mean time, the economy will struggle.

Fueling the Increase

If demand for crude is lower and supply is at significant highs, why is the price of crude rising. After all just a couple of years ago, $70 for a barrel of oil was considered a catastrophe. There are five reasons energy prices have risen They are falling value of the U.S. dollar, production cuts by OPEC, fear of inflation, traders anticipating the recovery of the global economy and some traders using oil to generate significant profits from its “store of value”.

The value of the U.S. dollar against a basket of currencies has fallen from a high of almost $0.90 in March 2009 to $0.80 most recently. It is up from a low of $0.72 in the summer of 2008. Oil is prices in U.S. dollars. If the price of the dollar falls, it lowers the value of oil, which hurts the producers. To offset this price reduction producers raise the price of their oil on the market. While the recent drop in the value of the dollar is not significant, there is a growing fear the dollar will fall further as the government tries to fund its growing deficit.

To help offset the excess supply of oil on the market OPEC is reported to

have some success in cutting production. There are creditable reports that up to

81% of OPEC producers comply with the cartels production quotas. This lower

production encourages traders to prop up the price of crude. In addition,

Oil traders are worried that the vast amount of money being spent by the

In addition, many traders are anticipating of a recovery in the global economy. As the economy recovers, demand for oil will rise, pushing up prices. Like any investor, these traders are willing to bid up the price, if they believe they can get a higher price later. Producers also recognize the same situation, so they are encouraged to ask for higher prices now as they believe prices will be higher later.

Taking Advantage of Cantango

Each of these four factors has a role in helping to encourage the price of oil to be higher. However, I do not believe they would cause a doubling in the price in such a short time. Oil trades on the futures markets. For each month, forward traders speculate what the price of oil might be. When the price over the forward months rises in an upward sloping curve, it is known as cantango. When oil is in contango, the price for delivery at a future date is higher than the spot price (the current price). It is also higher the farther out you go.

When oil traders see a contango situation that they believe will remain, it pays to buy oil now and hold it waiting for the higher price to come along. What if you had access to very low cost money and you could invest it in an asset that has the potential to rise, perhaps significantly, you would be very tempted to borrow the money if you had a place to invest it at a higher return.

It turns out oil traders, who have access to low cost money, are borrowing

all they can get, while buying oil for delivery sometime in the future. The

prime rate is set at 3.25%. Traders who bought oil at the $40.81 a barrel on

Dec. 5 could sell futures contracts for delivery next December at $54.65, a 34

percent gain. After taking into account storage and financing costs, investors

would earn about 11 percent, according to Andy Lipow, president of

According to Ship Charting “About six crude oil tankers, 20 oil product

tankers and four liquefied natural gas (LNG) tankers are floating off Malta, the

highest density of anchored tankers outside ports in the world, according to

AISLive ship tracking data on Reuters. That means at least 20 million barrels of

oil, or about a quarter of the world's daily demand, are on the seas around

U.S. investment bank JPMorgan Chase & Co has hired a crude supertanker to store gas oil off Malta's coast. Chase is one of the large banks that received TARP money and who has accessthe Feceral Reserve’s lending facility to help the economy avoid a depression. I am not saying that Chase is borrowing money from the Fed at extremelylow rates and then buying oil to make a profit, as I do not know this is taking place.

“The bottom line is that you buy crude at a low price and

lock in a profit by selling it forward,” said Mike Wittner, head of oil market

research at Societe Generale SA in

Royal Dutch Shell Plc sees so much potential in the

strategy that it anchored a supertanker holding as much as $80 million of oil

off the

How long this can investment continue? It depends on contango and how steep the curve remains. Should the curve flatten or even go down (called backwardation) the traders will be selling the oil as fast as they can. This will force prices down. I suspect several traders have lock in their profits already, capturing part of their gains, and hedging the rest. It is likely a number of traders and firms are still long oil. Should these traders see the curve flatten, they will be desperate to sell their oil. Should this occur, we could see a fairly steep drop on the spot price.

What’s ahead

As investors who do not have access to a bank with a pipeline to the Federal Reserve, we are faced with a more difficult situation. Eventually the rising curve known as contango will reverse. When it does, it will push down the prices of the energy sector stocks and ETFs. This event will create an opportunity to buy into quality stocks and the sector overall.

The event of all this oil coming onto the market will be relatively short lived. Producers worldwide have cut back on investments in marginal projects due to the steep decline in oil prices. Many non-OPEC countries are already seeing a decline in the production capacity. This lack of investment will accelerate this problem. Even OPEC nations have curtailed some of their investment, which will hinder ramping up production when demand returns.

When demand returns in emerging countries as well as

The next drop in the price of oil should create an opportunity for stock and ETF investors, once an interim low is reached. We need to monitor the price of oil and whether it stays in contango over the next several months to get a better idea of what we should do next.

For those who want to learn more I suggest reading:

Ahead of the Curve: A Commonsense Guide to Forecasting Business

and Market Cycles![]() by Joe Ellis is an excellent book on how to predict macro moves

of the market.

by Joe Ellis is an excellent book on how to predict macro moves

of the market.

Featured sites

- Non Gamstop Casinos

- Online Casinos Not Registered With Gamstop

- Migliori Casino Non Aams

- Migliori Siti Casino Online

- Non Gamstop Casinos

- Casinos Not On Gamstop

- Non Gamstop Casinos

- Casino Online Non Aams

- Casino Italiani Non Aams

- Online Casino

- Non Gamstop Casino Sites UK

- Sites Not On Gamstop

- Casino En Ligne

- Meilleur Casino En Ligne France

- Non Gamstop Casino Sites UK

- Non Gamstop Casinos UK

- Sites Not On Gamstop

- UK Casinos Not On Gamstop

- Casino Non Aams

- Non Gamstop Casino

- Casino En Ligne Fiable

- Non Gamstop Casino

- Casino Sites Not On Gamstop

- Betting Sites UK

- UK Casino Not On Gamstop

- Non Gamstop Casinos

- Bitcoin Casinos

- Casino Belgique En Ligne

- Site De Paris Sportif Ufc

- 出金早い オンラインカジノ

- KYC 없는 카지노

- ставки на спорт букмекерские конторы

- Casino En Ligne Argent Réel

- Casino Bonus Sans Dépôt Immédiat

- Casino Non Aams

- Siti Casino Non Aams

- Casino En Ligne 2026

- Casino En Ligne Retrait Immediat

- Nouveaux Casinos En Ligne