4/5/2010

In normal times, a 3.2 percent GDP growth rate for the

What can we learn from the Bureau of Economic Analysis (BEA) report on the GDP growth rate that might be helpful to investors?

“Okun’s rule of thumb” points toward an economy that must

grow at the 3.0 – 3.5 percent level to maintain current employment levels. If

the

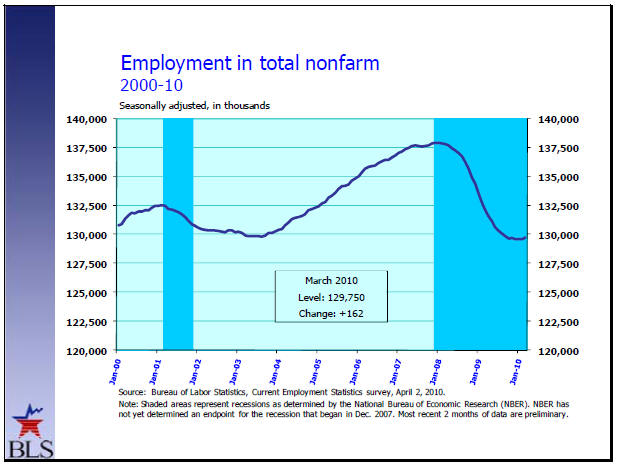

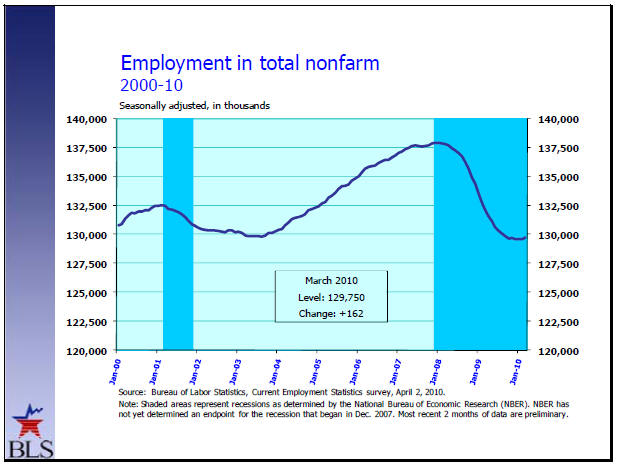

The chart below from the BLS report for March 2010 shows

that the total employment for the

Source: Bureau of Labor Statistics, Employment in total non farm

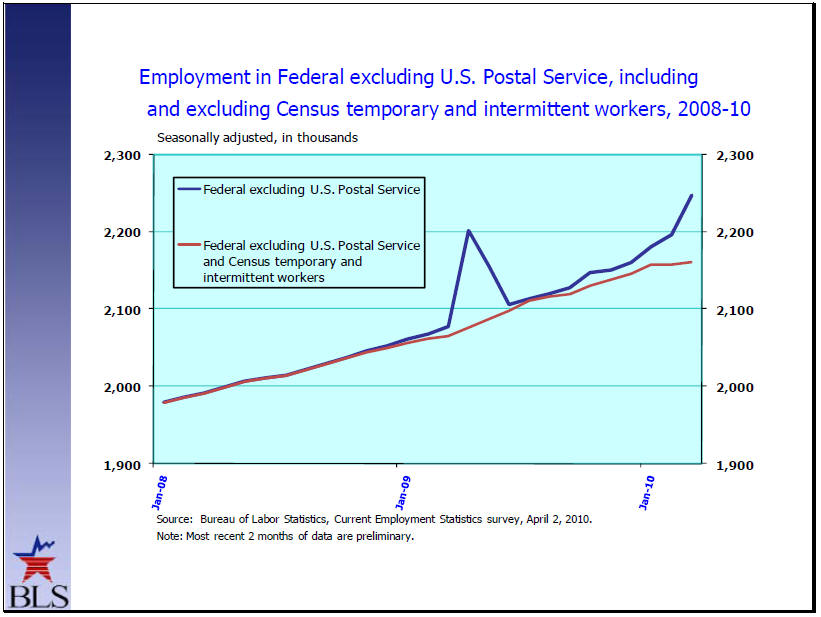

All sectors of the economy are experiencing negative growth or slight up ticks. However, employment in the federal government continues to expand as shown in the chart below. Expansion of the federal government contributes to the growth in the deficit. One of the problems with government employment is it is very difficult to scale it back once the positions are in place. Just look at the trouble state and local governments are having as they try to balance their budgets by cutting people.

Source: Bureau of Labor Statistics, Federal employment

A jobless growth economy will be constrained in its ability to expand. Personal consumption increased at a pace of 3.6 percent. However, almost that entire growth came from savings not from higher incomes. As many people become more confident in their job situation, they are willing to spend more. Since personal disposable income barely rose, a drop in the saving rate can explain the strength of household spending almost entirely. Unless income grows more strongly, we should expect slowing spending trends over the next few quarters as government stimulus payments to the private sector taper off.

The companies increased the value of goods on their

warehouse and store shelves by $31 billion in the quarter, contributing 1.6

percentage points to growth due to higher inventories. Should consumer spending

slow as expected this is likely to produce only small gains during the rest of

the year. Without an expansion in consumer income to fuel growth in spending,

consumers will dip into savings. Without growth in spending, inventories will

reverse course cutting the GDP growth rate further. Without expansion of

inventories, the country’s GDP looses an important growth driver.

Exports and imports climbed in the first quarter, as global trade continues

to bounce back from its lows during the financial crisis. However, imports rose

faster. As a result, net exports withdrew about 0.6 percentage point from the

GDP growth rate. The problems in

Helping to counter part of this export question is the expansion of the

emerging markets. Industries and sectors that benefit from the rapid growth of

countries like

Residential investment fell 10.9 percent as the housing sector continues to

suffer despite the first-time homebuyer credits that ended on

Equipment and software jumped about 13 percent though this was down from Q4's 19 percent consistent with what we have seen in orders/shipments for capital goods, especially primary metals, over the last six months.

Federal spending over the short run as countercyclical fiscal stimulus is welcome. Since this is the second year of the President’s stimulus package, it will be difficult to justify more, especially to an electorate tired of handouts to everyone but themselves. The large deficits and how to pay for them will be an election issue. Many people are upset that we are leaving our children saddled with an enormous debt that will reduce their living standards as they struggle to pay for our excesses. We will see rates climb, as investors grow leery of the never-ending deficits that are limiting private investment. Hopefully we won’t see riots in the street.

The anemic GDP growth rate will force investors to pick their opportunities carefully as a jobless growth economy will limit the opportunities. In this case, the tide has risen and it can no longer float all boats. While the tide might not be going out, it will not carry investors forward. This means stock pickers and well founded sector rotation strategies will carry the day.

If you are interested in a free monthly newsletter on the stock market trends, please send an email to [email protected] with your email address stating you wish to receive the Free Monthly Newsletter and you will be added to the list.

Our Premium Members receive frequent updates on important and relevant economic factors that affect the stock market, industry sectors and individual stocks and ETFs. Request a four-week free trial to the Premium Membership. There is no risk, nor any obligation. If you have any questions regarding membership, please send an email to [email protected] and we will get right back to you. Your complete satisfaction is of utmost importance to us.