Exchange Traded Funds (ETFs) offer investors an excellent way to take advantage of a sector rotation strategy. By concentrating on specific industry sectors, investors have a straightforward way to participate in the rotation of an industry sector. In a sector rotation strategy investors overweight ETF portfolios in strong sectors and underweight in weaker sectors.

At each stage of the economic cycle different industry sectors tend to out perform the market. This is the basis of the ETF sector rotation strategy. The performance of these sectors can be a factor of the stage of the business cycle, the calendar, and their geographic location. Investors seeking to beat the market would do well to identify which sectors are most likely to outperform over the the near future and overweight their ETF portfolios accordingly.

This is where sector based ETFs can be of great help. Using industry ETFs that correspond to the sector(s) that are more likely to do well in the next 6 to 12 months should offer better returns. The ETF sector rotation strategy takes advantage of the economic cycles by investing in the sectors that are rising and avoiding the ones that are falling.

Sector rotation is a blend of active management and long-term investing. Active in that investors need to do some homework to select the sectors they expect to perform well. Long-term in that you can hold some sectors for years.

Investors might consider three sector rotation strategies for their ETF portfolios. The most well known strategy follows the normal economic cycle. The other two strategies either follow the calendar or pursue a geographic strategy.

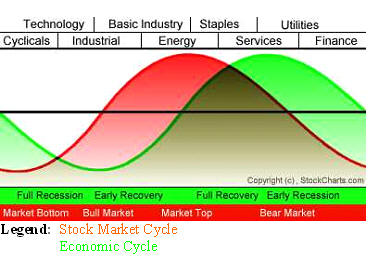

Sam Stovall of Standard & Poor’s describes a sector rotation strategy that assumes the economy follows a well-defined economic cycle as defined by the National Bureau of Economic Research (NBER). His theory asserts that different industry sectors perform better at various stages of the economic cycle. The nine Standard & Poor’s sectors are matched to each stage of the business cycle. Each sector follows their cycle as dictated by the stage of the economy. Investors should buy into the next sector that is about to experience a move up. When a sector reaches the peak of their move as defined the economic cycle, they should sell the sector's ETF. Using this strategy an investor may be invested in several different sectors at the same time as they rotate from one sector to another as directed by the stage of the economic cycle.

Sam Stovall's

Sector Investing, 1996![]() states that different sectors are stronger at different points along the

business cycle. The table below describes this theoretical model

throughout the business cycle. Be forewarned, this is a very expensive

book, however it is worthwhile, as it is the best explanation of sector

rotation strategy.

states that different sectors are stronger at different points along the

business cycle. The table below describes this theoretical model

throughout the business cycle. Be forewarned, this is a very expensive

book, however it is worthwhile, as it is the best explanation of sector

rotation strategy.

| Stage: Consumer Expectations: Industrial Production: Interest Rates: Yield Curve: |

Full Recession Reviving Bottoming Out Falling Normal |

Early Recovery Rising Rising Bottoming Out Normal (Steep) |

Full Recovery Declining Flat Rising Rapidly (Fed) Flattening Out |

Early Recession Falling Sharply Falling Peaking Flat/Inverted |

The graph, courtesy of

StockCharts.com, shows these relationships and the order the key

sectors respond to the economic cycle. The Stock Market Cycle precedes

the Economic Cycle as investors try to anticipate how the market will

react to the changes to the economy.

As an investor, I seek to understand where we are in the business

cycle to help guide me where to look for opportunities. An ETF sector rotation

strategy can produce excellent opportunities and must be carefully

examined when evaluating the business cycle.

As an investor, I seek to understand where we are in the business

cycle to help guide me where to look for opportunities. An ETF sector rotation

strategy can produce excellent opportunities and must be carefully

examined when evaluating the business cycle.

The best money is made by being in the right sector at the right time. The problem is deciding when to make the transition to a sector that had greater potential. Moving one's capital to a new sector too early will result in weak performance at best with losses more likely. On the other hand, if one is late getting into the sector you miss much of the uptrend and as a result much of the potential profit.

One of the key elements of the ETF sector rotation strategy is to hold shares in more than one sector. The idea is to buy into the sector that is rising toward the top and then hold it until it turns down. As a sector turns down an investor rotates their money to the next sector ETF that is rising toward the top and is expected to outperform. This strategy often means an investor will be holding a minimum of three sectors in their ETF portfolio; one sector on the rise, one at the top and one that is starting to decline.

The economic cycle provides investors with an excellent way to employ a sector rotation strategy using ETFs. Investors can use this approach to enhance their returns with a proven investing strategy.

The Christmas holiday often provides retailers with additional sales opportunities. The mid summer period before students go back to school often creates additional sales opportunities for retailers. People in the Northern Hemisphere tend to drive their cars more during the summer months. This increases the demand for gasoline and diesel creating opportunities for the refiners.

These events are all examples of using the calendar to develop an ETF sector rotation strategy. For example, industries that depend on the changes in the seasons such as winter vacations present another calendar opportunity for investors.

In a global economy, there are many investors who seek to enhance their returns by investing in countries or geographies that are expected to grow faster than average. This growth could come from the demand for the products or services these countries offer. Alternatively, the country or region might be experiencing unusually rapid economic growth that is expected to last for several years.

A geographic based sector rotation strategy overweight's ETFs that focus on a country or the region. In addition, you could incorporate the economic cycle analysis to develop a better understanding of which industry sectors will contribute to the countries success. Using ETFs that emphasize a country or geographic region is a sector rotation strategy that helps to spread the risk of investing in specific companies in the country or region, something more difficult for many individual investors to accomplish.

While ETFs can

help investors create a more diversified portfolio, they can also create

inadvertent risk by concentrating on one sector. Investors can reduce this risk

by investing in

several different sectors at the same time, weighted according to your

expectations of future performance. By using a sector rotation strategy, investors can create a more diversified portfolio

that helps to reduce the risk of being wrong in any one investment. In addition,

this strategy can spread stock selection risk across all companies in the

ETF. Investors should be careful they

do not create unwanted concentration in any one sector, especially when using a

blend of the economic cycle, calendar and geographic strategies.

With so many ETFs available to use in your sector rotation strategy, it is important to understand the investing plan and portfolio makeup of the ETF before committing capital. Moreover, lightly traded ETFs pose additional risk in that it may be difficult to sell quickly if there is no underlying bid for the shares.

ETFs are not without other risks as well. Before you make a commitment to any ETF be sure you understand the underlying risks of the ETF.

Sector ETFs allow an investor to take advantage of the higher than average performance of one or more sectors in the near future. A portfolio that fully invests in a diversified set of ETFs concentrated in sectors that should outperform the market, has the potential to generate above average returns and beat the market. This ETF sector rotation strategy can reduce the risk of losses due to exposure to high risk stocks. Moreover, by selling a portion of your holding in sectors that are transition past the peak of their cycle and reinvesting in those sectors that are expected to perform better than the market in the next few months, you are following a disciplined ETF sector rotation strategy.

If you are learning to invest, consider a sector rotation strategy that uses ETFs to provide investors an optimal way to enhance the performance of their portfolio that can increase diversification and performance. Just be sure to assess the risks before making a commitment of your money.

If you are interested in a free monthly newsletter on the stock market trends, please send an email to [email protected] with your email address stating you wish to receive the Free Monthly Newsletter and you will be added to the list.

Our Strong Sector Portfolio for our Premier Members employs an ETF sector rotation strategy that has beaten the market every year. If you are interested, request a no risk, free four-week trial. You have nothing to lose and money to make. There is no risk, nor any obligation. If you have any questions regarding membership, please send an email to [email protected] and we will get right back to you. Your complete satisfaction is of utmost importance to us.